Navigating finances can often feel like a chore, especially when you’re in a relationship. But what if we told you it doesn’t have to be? Welcome to our latest blog post, “Fun ways to save money as a couple.”

This article aims to turn the somewhat dull task of budgeting into a fun and rewarding experience. We will explore innovative and engaging methods that not only help you save money but also strengthen your bond as a couple.

After all, teamwork makes the dream work, and what could be more dreamy than achieving financial stability while having a blast together? Let’s dive in

Table of Contents

- Why you should save money as a couple

- Key Takeaways

- Saving Money as a Couple: Fun Ways to Create a Stronger Bond

- Grow vegetable garden together

- Split a coffee

- Pack each others lunches

- Go on library dates

- Camp together

- Go for grocery shopping together

- Visit thrift store or garage sale together

- Set money aside for surprises

- Set common financial goal

- Have saving competitions

- Take date nights midweek

- Go on daytime dates

- Workout together

- Bargain hunt together

- Find travel deals

- Mystery shop together

- Have weekly money meetings

- Conclusion

- FAQs

Why you should save money as a couple

Saving money as a couple isn’t just about growing your joint savings account. It’s also about building a strong, unified relationship. According to various sources, merging finances can not only help you save faster through compound interest but also make bill paying and budgeting more transparent1. There are several strategies couples can use to save money together. These include drawing up a joint budget2, tracking spending, developing a savings plan, and even adding a spouse onto an employer health insurance plan to save on costs.

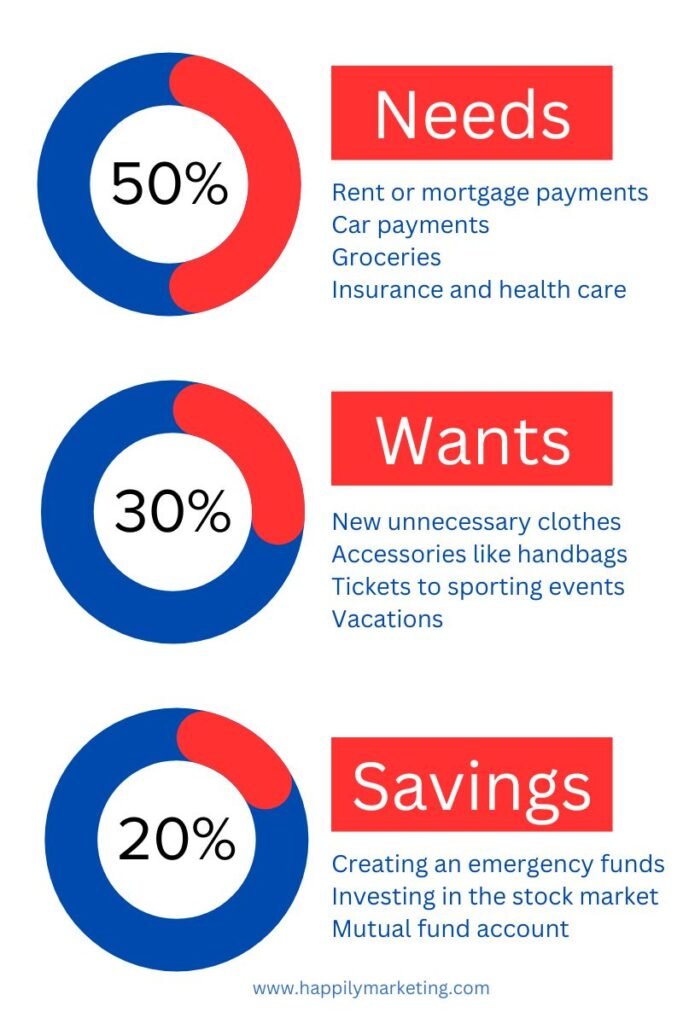

However, how much should a couple save? The 50/30/20 rule of thumb suggests that 20% of your income should go towards savings, 50% should be allocated for necessities, and the remaining 30% is for discretionary items. But remember, these proportions might need tweaking based on your unique circumstances and financial goals.

Moreover, managing money jointly isn’t just about the numbers. Studies have shown that couples with similar spending habits and savings goals tend to have more successful long-term relationships. By understanding each other’s financial habits and priorities, couples can work together to achieve their goals and avoid financial conflicts.

So, if you’re ready to turn budgeting from a chore into a fun, relationship-strengthening activity, stay tuned for our top tips on fun ways to save money as a couple

Key Takeaways

Certainly, here are 10 effective ways for saving money as a couple:

🤝 Joint Budgeting: Create a joint budget to track your income and expenses. This will give you a clear view of your financial situation and help you identify areas where you can cut back.

✊🏻 Shared Goals: Set shared financial goals such as saving for a house, car, or vacation. This can motivate both of you to save more.

🍽️ Limit Eating Out: While it’s enjoyable to eat out, it can also be expensive. Try cooking at home more often and reserve dining out for special occasions.

💸 Debt Management: If one or both of you have debts, work on a plan to pay them off. High-interest debts can significantly drain your resources.

🤑 Automatic Savings: Set up automatic transfers to your savings account right after payday. You won’t miss the money if you never see it in your checking account.

🥳 Use Discounts and Coupons: Make use of discounts, coupons, and cashback apps when shopping. These small savings can add up over time.

🙅🏼 Downsize: Consider downsizing your home or car if it makes sense. Smaller spaces often mean lower costs in terms of rent, utilities, and maintenance.

📺 Cutting Subscriptions: Evaluate your subscriptions (like gym, streaming services) and cancel ones that you don’t use frequently.

💪🏻 DIY Projects: Instead of hiring professionals for small tasks like home repairs or decoration, try doing it yourself.

📈 Invest Together: Consider investing in stocks, bonds, or mutual funds together. This could potentially bring in additional income.

Remember, the key to successfully saving money as a couple is open communication and teamwork. Discuss these strategies with your partner and decide which ones work best for your situation.

Saving Money as a Couple: Fun Ways to Create a Stronger Bond

Saving money in relationship is crucial for financial security, but saving money without compromising or missing any fun with your partner is also important. Hence with clear communication with your partner you can start your saving journey. Here are some fun activities that you and your partner can do to save money and strengthen your bond.

Grow vegetable garden together

You don’t need to be a hardcore homesteader to know that growing some of your own food can actually save you money in the long run. Plus, it’s a fantastic way for you and your partner to enjoy the sunshine, get some exercise, and stay healthy.

All you really need is a little piece of land to plant on, like your backyard or even the side of your house, as long as it’s not too shaded. And don’t worry if you’re renting an apartment without your own yard – you can look online for local neighborhoods that offer community gardening opportunities.

Split a coffee

One concept that can have a significant impact on personal finance is “Split a coffee.” This practice involves splitting the cost of a coffee or other small expenses between friends, family, or colleagues. It is commonly practiced in various settings, such as catching up with friends at a café or during work breaks.

The benefits of “Split a coffee” extend beyond just saving a few dollars. By implementing this practice in a financial perspective, individuals can take control of their spending and make conscious choices about their expenses. It allows them to track their spending more effectively, which is essential for budgeting and reaching financial goals faster.

However, it’s important to consider potential drawbacks when it comes to relationships. Splitting costs too rigidly can sometimes create tension or an imbalance, especially if one person consistently pays more than the other. To avoid this, it’s crucial to have open and honest communication about financial expectations and find a system that works for both parties. For example, taking turns treating each other or alternating who pays for certain expenses.

Pack each others lunches

Common misconceptions couples may have about money and their careers. It’s easy to believe that financial success solely relies on big-ticket purchases or extravagant gestures. However, it’s often the small, consistent actions that make the most significant impact. One such action is packing each other’s lunches.

Not only does packing lunches together save money, but it also builds intimacy and promotes healthier lifestyle choices. By preparing meals together, couples can take control of their nutrition and make conscious choices about what they eat. This practice encourages communication, collaboration, and a sense of shared responsibility. It also allows couples to support each other’s well-being and goals for a healthier lifestyle.

To make lunch packing an easy and enjoyable experience, start by planning meals together and creating a grocery list based on both preferences. Batch cooking on weekends can help save time during busy weekdays. Consider investing in meal prep containers and reusable lunch bags to reduce waste and save even more money in the long run.

The positive impact of packing each other’s lunches extends beyond just financial savings. It strengthens the bond between partners and fosters a sense of togetherness. By taking this small step, couples demonstrate their commitment to supporting each other’s goals and priorities. It creates an opportunity for connection and nurtures a stronger partnership overall.

Read: How to Make Money on Pinterest Without a Blog?

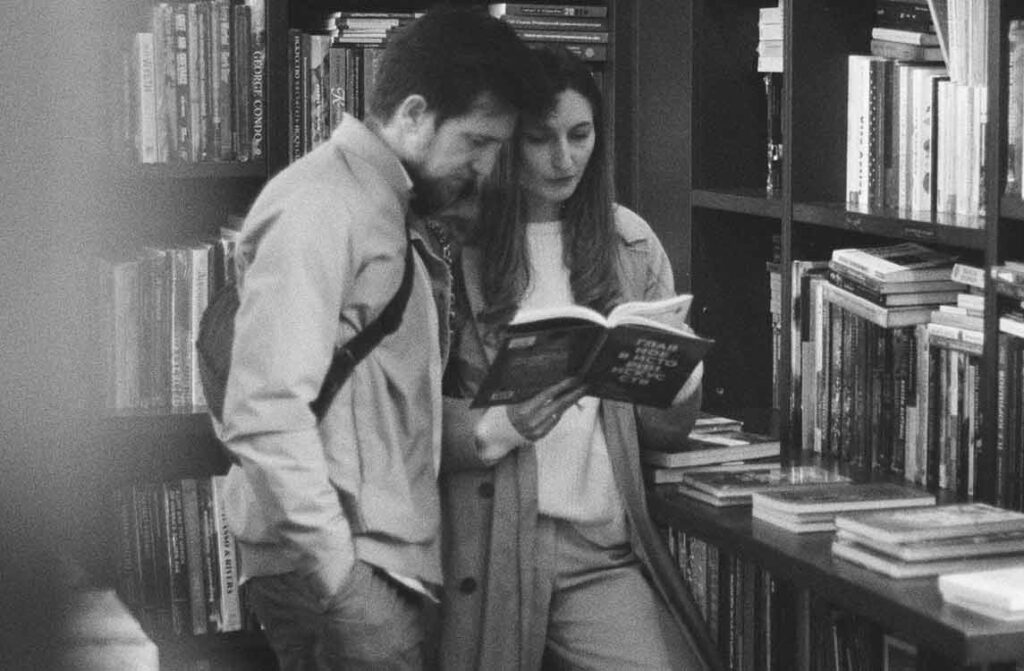

Go on library dates

It’s not only a fantastic way to spend quality time together but also an opportunity to discover new books, learn together, and do it all on a budget!

Library dates are a great idea for couples because they provide a unique and enriching experience. Exploring the shelves and discussing books can lead to stimulating conversations and deeper connections. It allows you to share your interests, learn from each other’s perspectives, and cultivate a mutual love for knowledge.

Not only do library dates offer intellectual exploration, but they also come with financial benefits. A library card is often available at minimal or no cost, making it an affordable option for couples who want to focus on the experience rather than the money spent. By opting for library dates instead of expensive dinners or vacations, you can save money while still enjoying quality time together.

To make the most of your library dates, consider planning ahead by researching book recommendations or participating in local library events together. Create a cozy reading nook at home where you can enjoy your newfound treasures and discuss them further. Don’t forget to explore different genres and authors, allowing yourselves to step outside your comfort zones and discover new favorites together.

Camp together

Planning a weekend camp with your partner can be a wonderful opportunity to strengthen your relationship and create unforgettable memories. Here are some tips and advice to make this experience enjoyable and affordable:

Benefits of Couple Camping: Camping allows couples to disconnect from their daily routines and immerse themselves in nature’s serenity. It provides an opportunity to bond and connect emotionally, away from the distractions of modern life. Spending quality time together in the great outdoors can deepen your relationship and create lasting memories.

Budgeting for the Trip: To make the camping trip affordable, consider the following:

- Split Expenses: Divide the cost of supplies, food, and transportation between the two of you.

- Choose Low-Cost Activities: Explore hiking trails, swimming in natural pools, or stargazing, which are usually free or low-cost.

- Look for Camping Deals: Check for discounts on campsites or consider camping in national parks, which often have lower fees.

Meal Planning: Save money and enjoy delicious meals by following these tips:

- Pack Simple and Nutritious Food: Opt for easy-to-prepare meals like sandwiches, pasta salads, and grilled vegetables.

- Avoid Expensive Meal Subscriptions: Instead of meal subscriptions, plan your meals in advance and bring the ingredients with you.

- Cook Together: Cooking as a couple can be a fun and romantic activity during the camping trip.

Remember, the key to a successful camping trip is planning, communication, and embracing the adventure together. Enjoy the serenity of nature, create beautiful memories, and strengthen your bond as a couple.

Go for grocery shopping together

Let’s talk about an activity that may not sound glamorous but can actually be a game-changer for your relationship and finances: grocery shopping together.

Not only does shopping for everyday essentials provide an opportunity for you to bond over shared interests, but it’s also a great way to ensure that you stick to a budget. Here’s why:

- Building Trust: Grocery shopping together requires working as a team and making decisions together. This process allows you to build trust in each other’s choices and preferences. It’s a chance to learn more about each other’s tastes, preferences, and values when it comes to food and money.

- Sticking to a Budget: Creating a joint shopping list is a smart move. By planning meals and snacks together, you can work as a couple to choose affordable options and only purchase what you truly need. This helps to avoid those tempting impulse buys that can quickly add up and blow your budget out of the water.

- Splitting the Bill: When you shop together, you have the advantage of splitting the bill. Sharing the cost of groceries can help ease the financial burden on one person and promote a fair division of expenses. Plus, it can save you both money in the long run.

- Discovering New Favorites: Exploring the aisles of the grocery store together can be surprisingly fun and exciting. You might stumble upon new products or ingredients you’ve never tried before. This opens up opportunities for culinary adventures and discovering new favorite foods as a couple.

So, the next time you need to stock up on groceries, consider making it a date! Enjoy quality time together while tackling your shopping list. It’s a chance to bond, communicate, and make healthier financial choices as a team. This is one the best Fun Ways To Save Money As A Couple

Read: How Do Nomads Make Money in 2023? 17+ Top Strategies

Visit thrift store or garage sale together

Looking for cost-effective yet meaningful ways to spend quality time together as a couple? Visit thrift store or garage sale with your partner. These treasure-hunting adventures can be a fun and budget-friendly way to discover new things and create lasting memories.

As you explore these thrifty havens together, you can help each other find unexpected gems at reduced prices. It’s like embarking on a scavenger hunt where the prize is a unique and affordable treasure. Not only does this activity promote bonding, but it also encourages creativity.

You never know what you might find – a vintage piece of furniture that can be beautifully restored or a quirky item that can be repurposed into something entirely new.

To make the most of your thrift store or garage sale outings, here are some practical tips:

- Negotiate Prices: Don’t be afraid to haggle. Many sellers at garage sales are willing to negotiate, allowing you to get an even better deal.

- Scout for the Best Sales: Keep an eye out for community-wide garage sales or special thrift store promotions. This way, you can maximize your options and potentially find more hidden treasures.

- Quality Check: While thrift shopping, examine items closely to ensure they are in good condition. Look out for any damage or defects that may affect their functionality or longevity.

- Have an Open Mind: Embrace the thrill of the unexpected! Be open to exploring different sections of the store or browsing through items that may not immediately catch your eye. You might stumble upon something incredible.

So, grab your partner’s hand and embark on a thrifty adventure together. Enjoy the excitement of the hunt, spark your creativity, and create a shared collection of unique finds. It’s a fantastic way to bond while keeping your expenses in check. Happy hunting!

Set money aside for surprises

Setting money aside for surprises. Having a financial safety net provides numerous benefits. It can alleviate stress during challenging times, prevent you from going into debt, and help you regain control when the unexpected happens. By preparing for the unexpected, you’ll sleep easier knowing that you have a cushion to fall back on.

So how can you build a rainy-day fund? Start by setting up a budget and figuring out your monthly expenses. This will give you a clear idea of how much you can save each month.

Even if it’s just a small amount, every little bit counts. Consider automating your savings by setting up automatic transfers to a separate savings account. This takes the decision-making out of the equation and ensures consistent contributions.

Flexibility is key. You don’t need to save a large sum all at once. Focus on setting achievable goals and gradually increasing your savings over time. Remember, it’s about progress, not perfection.

Additionally, explore flexible options that can help you achieve your financial goals faster. Look for high-yield savings accounts or consider investing in low-risk, easily accessible assets. The key is finding a balance between growth potential and liquidity, so your money is readily available when you need it.

Set common financial goal

Setting common financial goals – a crucial step in building a strong and thriving long-term relationship. When you align your financial aspirations, you not only strengthen your bond but also set yourselves up for a more secure and fulfilling future together.

The process of establishing these goals starts with open and honest communication. Sit down together and discuss your individual dreams, aspirations, and priorities. Then, find the common ground where your financial objectives intersect. This collaboration creates a shared vision that you can work towards as a team.

Have saving competitions

Engaging in friendly competition with your partner can not only nurture your relationship but also propel you towards your shared objectives.

One of the major benefits of saving competitions is that it creates a sense of accountability and teamwork. By setting targets and tracking your progress together, you’ll stay motivated and support each other along the way. It adds an element of fun and excitement to the journey towards financial success.

Here are some examples of challenges you can undertake as a couple:

- “Savings Sprint”: Set a specific timeframe, like a month or a quarter, and challenge each other to save as much as possible during that period.

- “Expense Slasher”: Identify areas where you can cut back on expenses and challenge each other to find creative ways to save money.

- “Debt Crusher”: Set a target for paying off debts and compete to see who can make the most progress in reducing debt balances.

To maintain your savings beyond the competition, consider using resources or tools like budgeting apps, expense trackers, or automatic savings apps. These can help you stay on top of your finances, continue saving, and achieve long-term financial stability together.

So, why not turn saving into a fun and exciting challenge? Compete, support each other, and watch your financial dreams become a reality. Together, you’ve got this.

Read: How To Generate Passive Income With No Initial Funds

Take date nights midweek

Let’s talk about the importance of midweek date nights and how they can work wonders for your relationship. We all know that life gets busy, but setting aside time for regular dates, especially in the middle of the week, can do wonders for keeping the romance alive.

Scheduling midweek dates offers several advantages worth considering. Firstly, you’ll avoid the weekend crowd at popular venues, giving you a more intimate and relaxed experience. You can enjoy a quieter atmosphere, have more personal attention from staff, and truly focus on each other without distractions.

Another benefit is that midweek dates tend to be more affordable. Many establishments offer special deals or discounts during weekdays, allowing you to enjoy a romantic outing without breaking the bank. So, not only can you prioritize your relationship, but you can do so in a cost-effective way.

When planning your midweek date nights, consider low-cost activities that can still be incredibly enjoyable. Take a sunset stroll in a local park, have a cozy picnic at home, explore a nearby hiking trail, or have a movie night with homemade popcorn and your favorite films. These options are not only budget-friendly but also allow for quality time and meaningful connections.

Go on daytime dates

Daytime dates refer to those outings you enjoy during the daylight hours, and they come with a range of benefits that can positively impact your connection.

One of the major advantages of daytime dates is their budget-friendliness. Often, daytime activities are more affordable than evening outings. You can save money on dining out by opting for a brunch or lunch date instead of a fancy dinner.

Plus, many outdoor activities or community events are free or have minimal costs associated with them. So, you can enjoy quality time together without putting a strain on your finances.

When it comes to daytime date ideas, get creative! Explore new parts of your city, visit local attractions, take a cooking or art class, go for a scenic drive, or visit a museum. The key is to try something different and break away from your usual date routine.

So, why not give daytime dating a try? It’s an excellent way to save money, infuse some variety into your relationship, and create memorable experiences together. Get out there, enjoy the sunlight, and let your love shine bright!

Workout together

Working out together as a couple can bring a range of benefits to your relationship and save some cash on dates. Here are some key advantages:

Exercising with your partner provides built-in motivation and accountability. You can encourage each other to stay on track, push through challenging workouts, and achieve your fitness goals together. Shared physical activities can help strengthen the emotional bond between couples.

Working towards a common goal, supporting each other during workouts, and celebrating achievements together can deepen the connection and create a sense of unity.

In our busy lives, finding quality time can be a challenge. By working out together, you carve out dedicated time for each other while also taking care of your health. It’s an opportunity to engage in conversation, connect, and enjoy each other’s company without distractions.

Exercising together creates an environment for open communication. Whether it’s discussing workout plans, sharing progress, or providing feedback, you can enhance your communication skills as a couple and strengthen your overall understanding of each other.

Friendly competition can spice up your workouts and bring excitement to your exercise routine. Competing in challenges, races, or games can push you both to perform better and motivate each other to reach new levels of fitness.

When you work out together, you become each other’s support system. You can provide encouragement, celebrate milestones, and offer a helping hand during challenging exercises. This mutual support strengthens your bond and empowers each other to push beyond limits.

Exercising together often extends beyond the gym or fitness activities. It can influence other aspects of your lifestyle, such as making healthier food choices, prioritizing sleep, and managing stress. As a couple, you can inspire and motivate each other to adopt healthier habits overall.

Regular exercise has been linked to increased libido and improved sexual function. When you work out together, you may experience a boost in intimacy and a deeper connection with your partner.

Working out together as a couple can have a positive impact on both your physical health and your relationship. It can provide an avenue for bonding, support, and shared experiences that contribute to a happier and healthier partnership. Hence try to spend some sport time with your partner, rather than a fancy date night and write this down in the list of your fun ways to save money as a couple.

Bargain hunt together

Bargain hunting together can be a fun and rewarding activity that brings couples closer while helping them save money. Simply put, bargain hunting is the art of finding the best deals and discounts on products and services. By embarking on this journey together, couples can enjoy several benefits. First and foremost, it can significantly reduce expenses, allowing you to stretch your hard-earned money further.

Utilizing coupons, taking advantage of sales, and shopping at discount stores are just a few strategies couples can employ to save big. To make bargain hunting even more enjoyable, turn it into a friendly competition. Challenge each other to find the best deals or see who can save the most money in a month.

This not only adds excitement to the process but also encourages teamwork and communication. The money saved from bargain hunting can be used to strengthen your relationship in various ways. Consider investing in memorable experiences like romantic getaways or trying out new activities together. Alternatively, you can use the extra funds to pay off debt, contributing to a healthier financial future as a couple.

So grab your partner’s hand and embark on a bargain hunting adventure – not only will it save you money, but it will also bring you closer and open up new possibilities for your relationship.

Find travel deals

Planning a trip and finding great travel deals can be both exciting and budget-friendly if you know where to look. Here are some practical tips to help you save money while planning your next adventure. First, take advantage of travel deal websites.

These websites gather the best deals from multiple sources, allowing you to easily compare prices and find amazing discounts on flights, accommodations, and vacation packages. Another way to score the best deals is by booking early. Airlines and hotels often offer discounted rates for early bookings, so keep an eye out for those advance purchase deals.

Being flexible with your travel dates and destinations can also make a big difference. Consider traveling off-season or during weekdays when prices tend to be lower. By avoiding peak travel times, you can enjoy significant savings. Planning ahead and comparison shopping are essential.

Research different options, compare prices, and read reviews to ensure you’re getting the best value for your money.

Additionally, keep an eye out for special promotions and limited-time offers that can save you even more. Lastly, be mindful of unnecessary travel expenses. Look for free or low-cost activities at your destination, pack light to avoid baggage fees, and consider using public transportation instead of expensive taxis.

Remember, saving money while planning a trip doesn’t mean sacrificing quality or fun. With a bit of research and smart decision-making, you can create memorable experiences without breaking the bank. Happy travels!

Mystery shop together

Are you and your partner looking to strengthen your financial relationship? Enter the world of Mystery Shopping together, a unique and insightful approach that can transform how you manage your finances as a couple. Think of Mystery Shop as a way to uncover hidden aspects of your financial habits and uncover opportunities for improvement.

By embarking on this journey together, you’ll learn the importance of open communication and transparency in every aspect of your relationship. The Mystery Shop experience allows couples to identify their financial strengths and weaknesses, addressing topics that might otherwise be challenging to discuss.

It’s an opportunity to gain valuable insights into your spending patterns, saving habits, and financial goals. Armed with this newfound knowledge, you can work together to create a solid financial plan that suits both of your needs and aspirations.

After completing the Mystery Shop, it’s vital to implement practical changes. Start by setting shared financial goals and creating a budget that aligns with your values and priorities.

Consider designating roles and responsibilities within your financial partnership, ensuring that each person has a voice and feels empowered to contribute. Regularly review your progress, celebrate milestones, and make adjustments along the way.

The Mystery Shop isn’t just an exercise; it’s a catalyst for positive change in your financial relationship. Take the leap and embark on this journey together. Discover the power of understanding, collaboration, and growth. Your financial future as a couple will thank you.

Have weekly money meetings

In any relationship, open and honest communication is the foundation for success, especially when it comes to finances. That’s why I strongly recommend adopting a weekly money meeting routine with your partner. These regular meetings provide an opportunity to strengthen financial communication and work towards shared wealth-building goals.

During these meetings, you can discuss a range of important topics, such as budget planning, investment strategies, and debt management. By addressing these areas together, you gain a deeper understanding of each other’s financial values and priorities. This increased transparency allows you to align your goals and make informed decisions as a team.

Beyond the immediate financial benefits, holding weekly money meetings has a profound impact on your relationship itself. It fosters trust, understanding, and a sense of shared responsibility. By openly discussing your aspirations, challenges, and progress, you’ll develop a stronger bond and be better equipped to navigate future financial hurdles together.

Additionally, these meetings provide an avenue for personal and joint growth. You can discover new strategies, learn from each other’s experiences, and celebrate milestones along the way.

To make the most of your weekly money meetings, establish a comfortable and non-judgmental atmosphere. Set goals, create an agenda, and allocate time for each topic. Remember, the purpose of these meetings is not to assign blame or critique, but rather to collaborate and find solutions together. By consistently investing time in your financial communication, you’ll reap long-term benefits that extend beyond wealth accumulation. Start holding your weekly money meetings today and build a strong foundation for financial success and a thriving relationship.

Conclusion

As we wrap up, let’s remember why saving money as a couple is so important. It’s not just about building a nest egg or achieving financial goals; it’s about strengthening your relationship and creating a secure future together. By working as a team and embracing a few fun strategies, saving money doesn’t have to be a tedious task. In fact, it can be enjoyable and even bring you closer.

Take the time to explore creative ways to save money together with one income or more. Plan budget-friendly date nights, cook meals at home instead of dining out, or embark on adventures that don’t break the bank. Get in touch with your inner DIY spirit and find joy in tackling projects together, whether it’s gardening, home renovation, or crafting thoughtful gifts.

Communication is key. Keep those lines open and discuss your financial goals and aspirations regularly. Celebrate milestones along the way and support each other through the ups and downs.

If you need additional assistance, consider using helpful tools like a budgeting app or consulting with a financial planner who specializes in couples’ finances.

Remember, saving money is not just about restriction or deprivation; it’s about making conscious choices that align with your values and priorities. By approaching it with love, teamwork, and creativity, you’ll discover the true joy and fulfillment that comes from being in control of your financial future together.

So, let’s embark on this savings journey hand in hand. Start implementing the tips we’ve discussed and watch your savings grow. You have the power to build a strong financial foundation and create a life of abundance and happiness.

Believe in yourselves, support each other, and enjoy the rewards that come with successfully managing your finances as a couple. Cheers to a prosperous future filled with love and financial security!

FAQs

How to save money with a girlfriend

Saving with your girlfriend doesn’t have to be a daunting task. In fact, it can be an exciting and rewarding journey that strengthens your bond while boosting your bank account. Here are some helpful insights to get you started on your savings adventure together. First and foremost, avoid overspending by setting clear financial boundaries and discussing your spending habits openly.

Plan a budget that works for both of you, accounting for shared expenses and individual savings goals. Consider using apps to track your expenses and keep you accountable. When it comes to finding affordable activities, get creative! Explore local parks, have a cozy movie night at home, or plan a picnic instead of dining out.

Sharing expenses can also help lighten the load.

Take turns footing the bill when going out and split the cost of groceries and household expenses. It’s all about finding a fair balance that works for both of you. Real-life examples can provide inspiration too. Choose experiences over material possessions, like booking a weekend getaway or taking a cooking class together.

Remember, the key is to support each other and make saving money a fun and collaborative endeavor. By implementing these tips and utilizing tools that simplify your financial journey, you’ll create a solid foundation for a happy and financially secure future. So go ahead, embrace the savings challenge with your girlfriend and enjoy the rewards that come with a shared commitment to financial wellness.